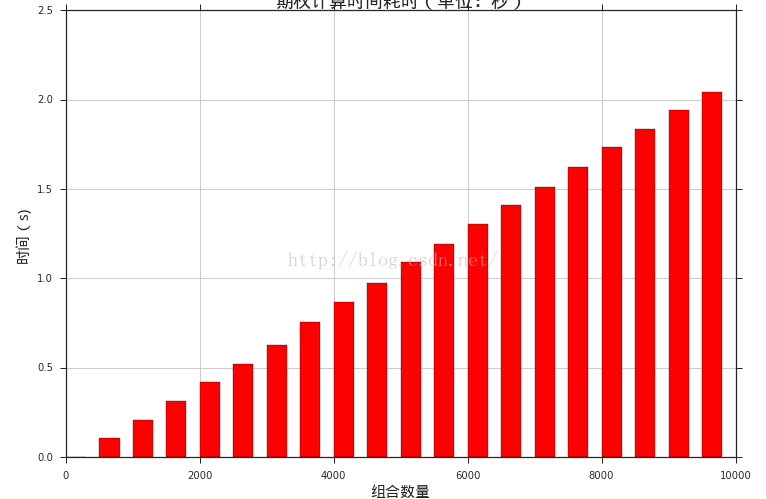

python程序运行时间-期权组合计算

spot = 2.45

strike = 2.50

maturity = 0.25

r = 0.05

vol = 0.25

from math import log, sqrt, exp

from scipy.stats import norm

def call_option_pricer(spot, strike, maturity, r, vol):

d1 = (log(spot/strike) + (r + 0.5 * vol *vol) * maturity) / vol / sqrt(maturity)

d2 = d1 - vol * sqrt(maturity)

price = spot * norm.cdf(d1) - strike * exp(-r*maturity) * norm.cdf(d2)

return price

import time

import numpy as np

portfolioSize = range(1, 10000, 500)

timeSpent = []

for size in portfolioSize:

now = time.time()

strikes = np.linspace(2.0,3.0,size)

for i in range(size):

res = call_option_pricer(spot, strikes[i], maturity, r, vol)

timeSpent.append(time.time() - now)

from matplotlib import pylab

import seaborn as sns

from CAL.PyCAL import *

font.set_size(15)

sns.set(style="ticks")

pylab.figure(figsize = (12,8))

pylab.bar(portfolioSize, timeSpent, color = "r", width =300)

pylab.grid(True)

pylab.title(u"期权计算时间耗时(单位:秒)", fontproperties = font, fontsize = 18)

pylab.ylabel(u"时间(s)", fontproperties = font, fontsize = 15)

strike = 2.50

maturity = 0.25

r = 0.05

vol = 0.25

from math import log, sqrt, exp

from scipy.stats import norm

def call_option_pricer(spot, strike, maturity, r, vol):

d1 = (log(spot/strike) + (r + 0.5 * vol *vol) * maturity) / vol / sqrt(maturity)

d2 = d1 - vol * sqrt(maturity)

price = spot * norm.cdf(d1) - strike * exp(-r*maturity) * norm.cdf(d2)

return price

import time

import numpy as np

portfolioSize = range(1, 10000, 500)

timeSpent = []

for size in portfolioSize:

now = time.time()

strikes = np.linspace(2.0,3.0,size)

for i in range(size):

res = call_option_pricer(spot, strikes[i], maturity, r, vol)

timeSpent.append(time.time() - now)

from matplotlib import pylab

import seaborn as sns

from CAL.PyCAL import *

font.set_size(15)

sns.set(style="ticks")

pylab.figure(figsize = (12,8))

pylab.bar(portfolioSize, timeSpent, color = "r", width =300)

pylab.grid(True)

pylab.title(u"期权计算时间耗时(单位:秒)", fontproperties = font, fontsize = 18)

pylab.ylabel(u"时间(s)", fontproperties = font, fontsize = 15)

pylab.xlabel(u"组合数量", fontproperties = font, fontsize = 15)

从运行时间上来看,python计算还是蛮快的

声明:该文观点仅代表作者本人,牛骨文系教育信息发布平台,牛骨文仅提供信息存储空间服务。

- 上一篇: laravel5.2session的使用

- 下一篇: Android数组列表按照字母排序